CEO SUMMARY: Among other things, we declare the end to the heyday of the independent commercial lab company which offers a broad test menu to all types of office-based physicians. In its place springs forth the specialty or niche testing laboratory. Small and focused on a specific number of reference and esoteric tests, the number …

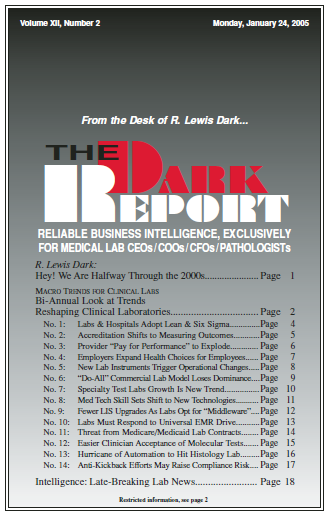

Bi-Annual Look at Trends Reshaping Clinical Labs Read More »

To access this post, you must purchase The Dark Report.