CEO SUMMARY: In presenting this list of macro trends for clinical laboratories, several themes are in play. They range from a continued emphasis on improving lab operations to the need to acquire and deploy sophisticated information technology. During the next few years, the long-predicted retirement of Baby Boomers will kick in. That will aggravate the …

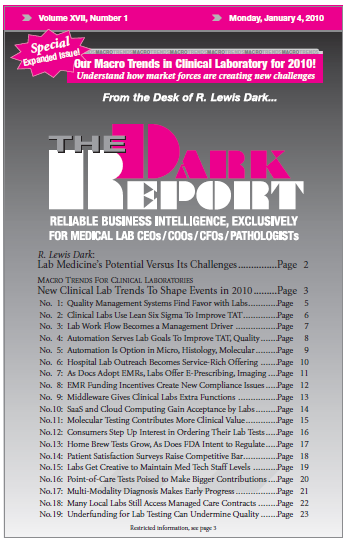

New Clinical Lab Trends To Shape Events in 2010 Read More »

To access this post, you must purchase The Dark Report.