CEO SUMMARY: Technology plays an ever-growing role in reshaping the organization and operation of clinical laboratories. New technologies figure prominently in THE DARK REPORT’S 2007 list of key trends in the clinical laboratory industry. Technological advances in instrument systems, informatics, and molecular diagnostics are giving laboratories new tools to improve clinical services and streamline lab …

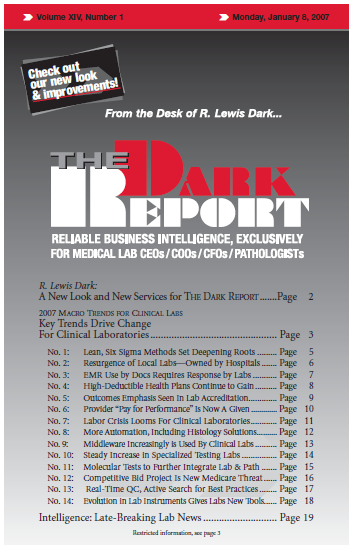

Key Trends Drive Change for Clinical Laboratories Read More »

To access this post, you must purchase The Dark Report.