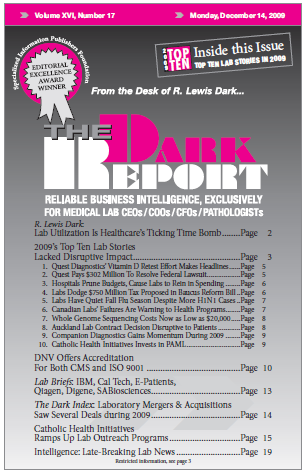

CEO SUMMARY: As the closing year of the first decade of the new century and the new millennium, 2009 brought neither disruption nor upheaval to the majority of laboratories in the United States. Rather, it was marked by at least two themes. One was how public disclosure of problems with lab testing services generated media […]

To access this post, you must purchase The Dark Report.