CONSOLIDATION OF INDEPENDENT CLINICAL LABORATORIES continued during 2009. The most active acquirer was Sonic Healthcare, Ltd., of Sydney, Australia. It purchased three laboratories in the United States this year. Just this month, Sonic acquired East Side Clinical Laboratory in Providence, Rhode Island. This acquisition gives Sonic a presence in New England. East Side was founded …

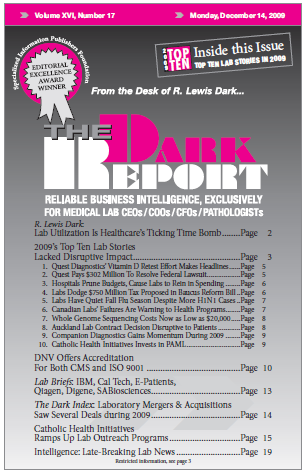

Laboratory Merger & Acquisitions Saw Several Deals during 2009 Read More »

To access this post, you must purchase The Dark Report.