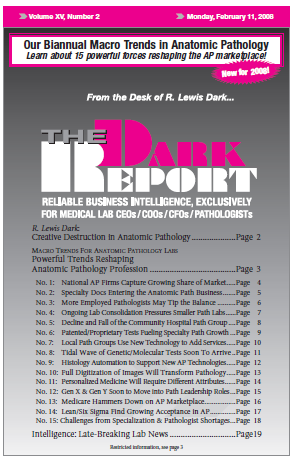

CEO SUMMARY: THE DARK REPORT presents its newest biannual review of macro trends reshaping the anatomic pathology profession. These macro trends reveal a profession undergoing change and transformation on multiple fronts. New competitors are crowding into the market, payers and accrediting agencies are demanding higher standards of performance, and a host of new technologies are …

Powerful Trends Reshaping Anatomic Path Profession Read More »

To access this post, you must purchase The Dark Report.