CEO SUMMARY: Given the specific news stories that make up THE DARK REPORT’S list of the “Top Ten Lab Stories for 2011,” it might be said that 2011 was a rather quiet year overshadowed by anticipation of the coming reforms mandated by the Accountable Care Act of 2010. For the clinical lab testing industry, 2011 …

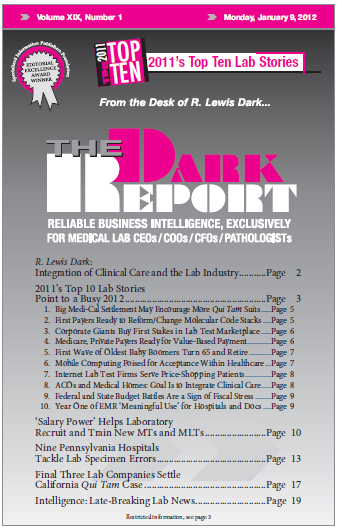

2011’s Top 10 Lab Stories Point to a Busy 2012 Read More »

To access this post, you must purchase The Dark Report.