CEO SUMMARY: Our biannual review of trends shaping the anatomic pathology profession reveals that a wide range of influences are active. The nation’s healthcare system is undergoing fundamental changes in how it views the quality of health services and how it will favor top-performing providers. For pathology group practices, this list of eight trends should …

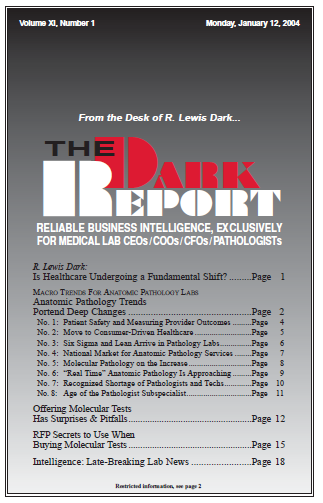

Anatomic Path Trends Portend Deep Changes Read More »

To access this post, you must purchase The Dark Report.