CEO SUMMARY: Laboratories that offer some of the new assays based on molecular technologies often find themselves facing significant financial risk. That’s because payers are skeptical about new lab tests which come at a high price, but don’t offer substantial clinical benefit. One early-adopter laboratory shares advice about how to identify, in advance, some of …

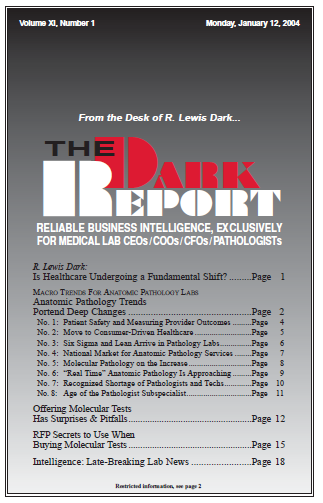

Offering Molecular Tests Has Surprises & Pitfalls Read More »

To access this post, you must purchase The Dark Report.