Story no.1 SGR Fix by Congress Spawns PAMA; Lab Industry Wary of Law’s Impact ON APRIL 1, PRESIDENT BARACK OBAMA signed into law the Protecting Access to Medicare Act of 2014 (PAMA). As written, it has the potential to be the most impactful federal legislation on the clinical lab industry since passage of the CLIA 1988 …

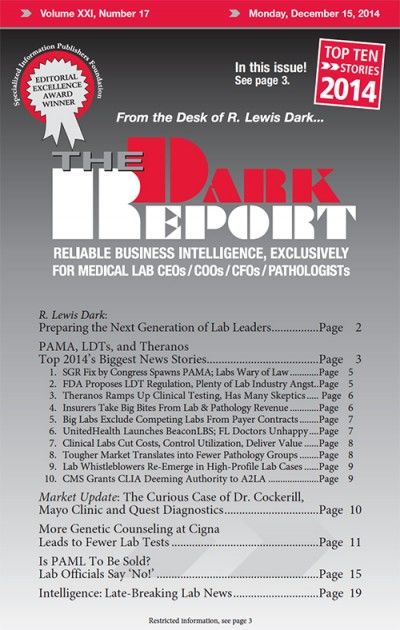

Top 10 2014 Biggest News Stories Read More »

To access this post, you must purchase The Dark Report.