CEO SUMMARY: Not in recent memory has a single calendar year brought such a cascade of news stories that have the potential to affect nearly every clinical lab and pathology group in the United States. Blame it on the lack of money to fund healthcare and how it is motivating government and private payers to …

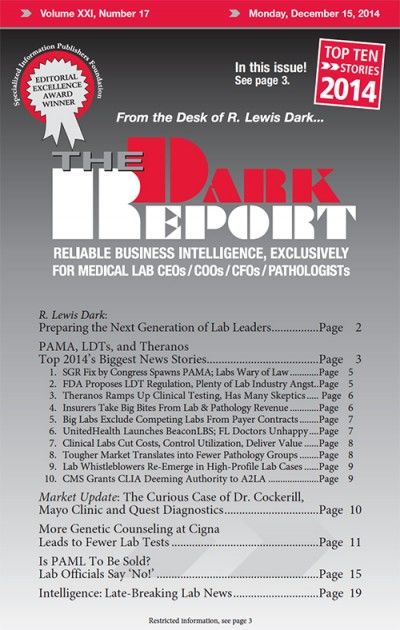

PAMA, LDTs and Theranos Top 2014 Biggest News Read More »

To access this post, you must purchase The Dark Report.