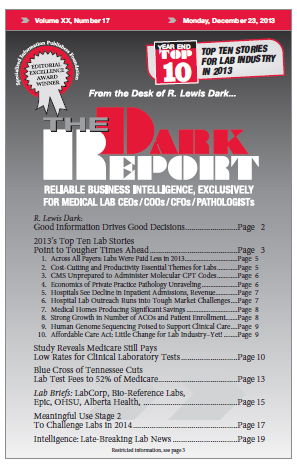

CEO SUMMARY: For 2013, the big story was money—or, more accurately, less money for providers. This was not limited to clinical labs and pathology groups, but was equally true of hospitals and physicians. In THE DARK REPORT’S annual lookback at the year’s 10 most important stories for the lab industry, the main theme is that …

2013’s Top Ten Lab Stories Point to Tougher Times Read More »

To access this post, you must purchase The Dark Report.