CEO SUMMARY: Researchers studied a database containing laboratory test prices paid in 2012 on behalf of 56 million Americans covered by private health plans and determined that, for most tests, and in most regions, Medicare already pays less than private health insurers for clinical laboratory tests. There are exceptions, but the findings provide a credible …

Study Reveals Medicare Already Pays Low Rates Read More »

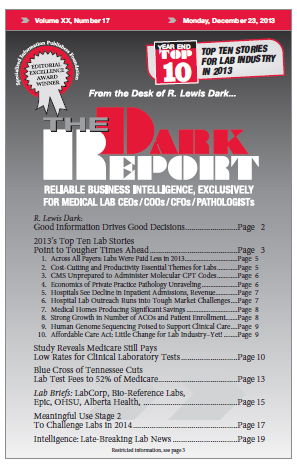

To access this post, you must purchase The Dark Report.