CEO SUMMARY: For the first time in recent memory, a year has passed without major tumult or disruptive change in the laboratory industry. Our list of the Top Ten Most Important Stories of 2008 reflects a rather quiet year when compared to most years of this decade. However, events continue to unfold in healthcare and …

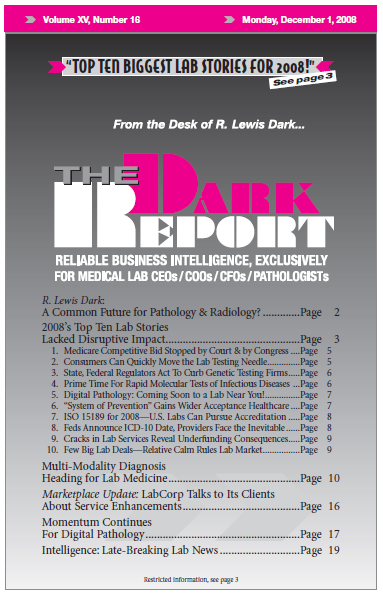

2008’s Top Ten Lab Stories Lacked Disruptive Impact Read More »

To access this post, you must purchase The Dark Report.