CEO SUMMARY: There is a new buyer for lab test data, creating an opportunity for labs to build a new revenue stream. Medivo, Inc., of New York, describes itself as a healthcare data analytics company whose mission is to unlock the power of lab data to improve health. It works with clinical labs and pathology …

Labs Can Earn Revenue through Data Analytics Read More »

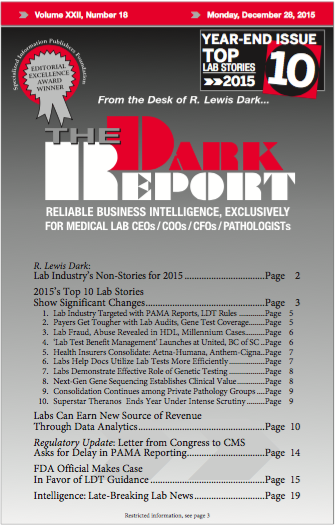

To access this post, you must purchase The Dark Report.