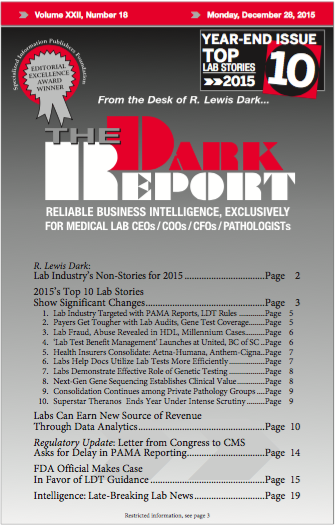

CEO SUMMARY: During 2015, two stories captured the full attention of most pathologists and clinical lab managers. One was how CMS intends to gather lab price market data as mandated by PAMA. The other was the continued efforts by the FDA to move ahead on proposed guidance for regulation of LDTs. However, the full list …

2015’s Top 10 Lab Stories Show Significant Changes Read More »

To access this post, you must purchase The Dark Report.