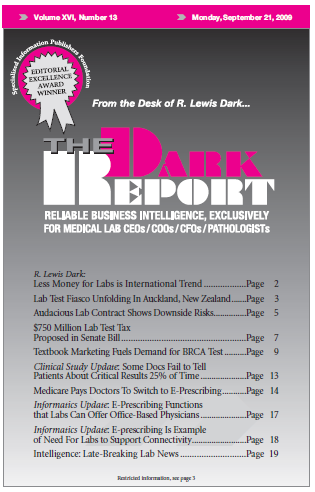

CEO SUMMARY: A bill that may be the U.S. Senate’s framework for reforming the U.S. healthcare system calls for a tax of $750 million per year to be paid by lab testing companies. The proposed bill also calls for a reduction in Medicare reimbursement for lab testing. One positive element was that reinstatement of the …

$750 Million Lab Test Tax Proposed in Senate Bill Read More »

To access this post, you must purchase The Dark Report.