CEO SUMMARY: Just as Nero is reputed to have fiddled while Rome burned, officials at CMS seem to be doing their own fiddling as their planned deep price cuts to Medicare Part B lab tests could begin driving lab companies out of business. In recent weeks, the owners of two lab companies decided to sell …

Tougher Times Ahead as Labs React to Fee Cuts Read More »

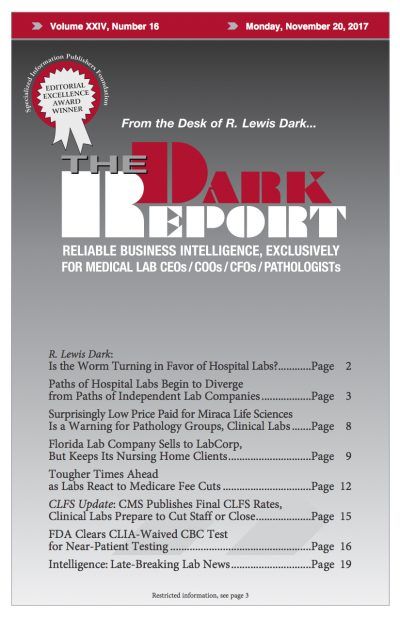

To access this post, you must purchase The Dark Report.