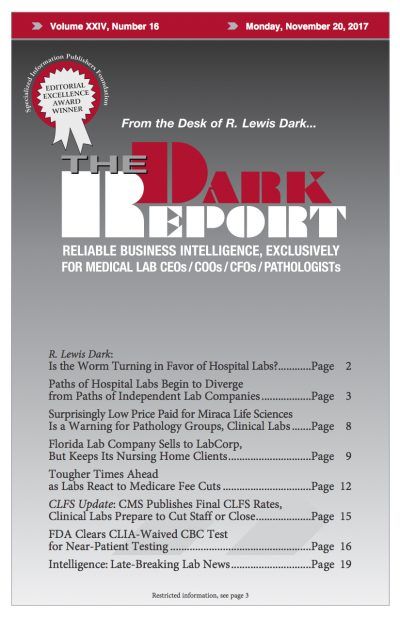

CEO SUMMARY: With each passing year, the primary role of hospital and health system labs evolves in a different direction than that of independent lab companies. This trend is a response to the creation of integrated delivery networks paid on value and how they are scored on their ability to keep patients out of hospitals …

Paths of Hospital Labs, Independent Labs Diverge Read More »

To access this post, you must purchase The Dark Report.