EVEN INTO THE MID 1980s, coal miners used canaries as an early-detection system for the presence of carbon monoxide and other toxic gases. In this way, canaries served as a sentinel species to save miners’ lives. Clinical laboratories and pathology groups don’t have a sentinel species to warn them about trouble ahead, but they do …

Surprisingly Low Price Paid for Miraca’s AP Lab Is a Warning Read More »

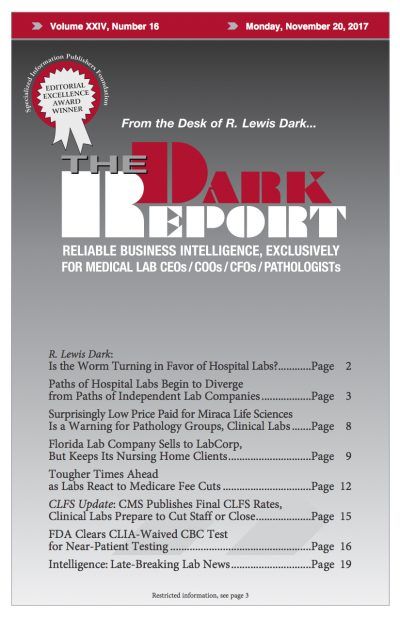

To access this post, you must purchase The Dark Report.