CEO SUMMARY: With the year end approaching, lab buyers and sellers are working to finalize deals that may have been in discussion for months. The first big lab acquisition for this season came on Nov. 27, when Quest Diagnostics announced it was acquiring Boyce and Bynum Pathology Laboratories of Columbia, Mo. The pathologists will keep …

Boyce & Bynum Sells to Quest Diagnostics Read More »

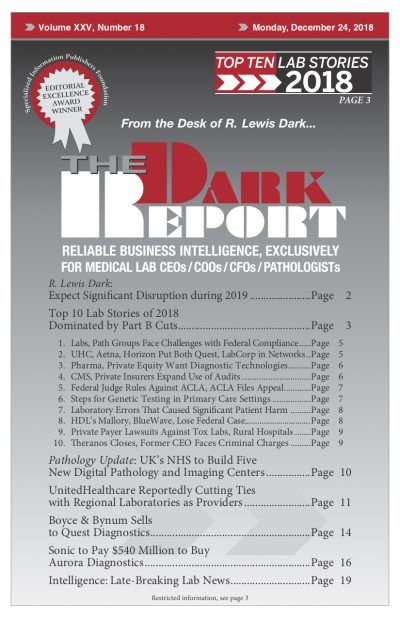

To access this post, you must purchase The Dark Report.