CEO SUMMARY: By cutting out smaller, regional labs, UnitedHealthcare appears to want to shift an unknown percentage of its lab test volume to Quest Diagnostics Inc., which it recently restored to its national provider network. Clinical lab directors should be concerned about this development because UHC is the nation’s largest health insurer and because other …

UHC Reportedly Cutting Ties with Regional Labs Read More »

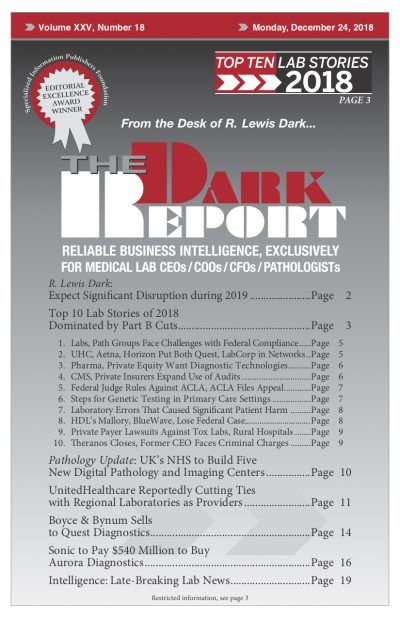

To access this post, you must purchase The Dark Report.