CEO SUMMARY: Sonic Healthcare, Ltd., announced that it would pay $540 million—a multiple of 9.2 times EBITDA—to acquire Aurora Diagnostics, the anatomic pathology company based in Palm Beach Gardens, Fla. Sonic will gain 32 pathology practice sites and add 220 pathologists to its network of regional clinical and pathology laboratories. The transaction marks the end …

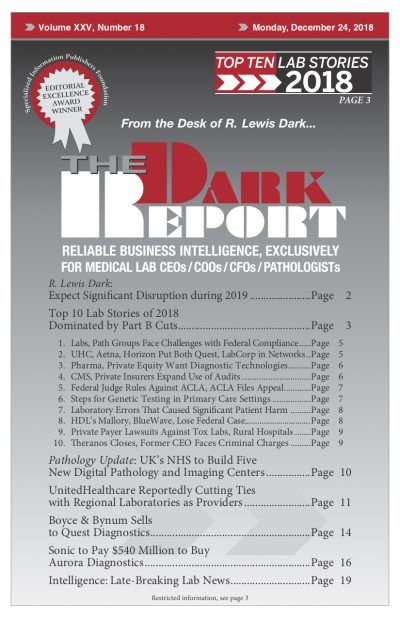

Sonic to Pay $540 Million to Buy Aurora Diagnostics Read More »

To access this post, you must purchase The Dark Report.