CEO SUMMARY: What makes 2010 a watershed year for the laboratory testing industry is enactment of the 2,700-page Patient Protection and Affordable Care Act (PPACA). Even if parts of this bill are repealed, the remaining parts of the massive legislation will trigger major changes to the healthcare system as it operates today. Other stories in …

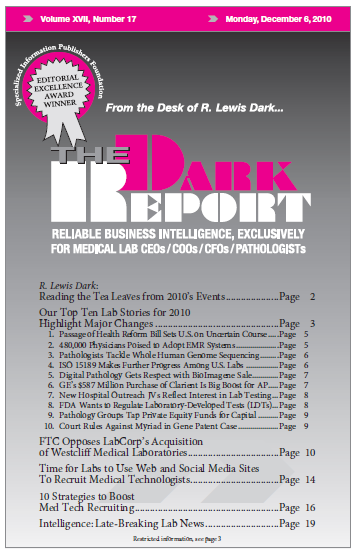

Our Top Ten Lab Stories Highlight Major Changes Read More »

To access this post, you must purchase The Dark Report.