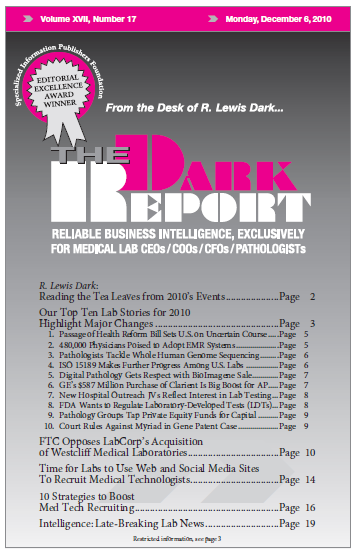

CEO SUMMARY: On November 30, FTC commissioners filed an administrative complaint opposing Laboratory Corporation of America’s acquisition of Westcliff Medical Laboratories, Inc., on the grounds that it “violates antitrust laws and would lead to higher prices and lower quality in the Southern California market…” This is the first serious FTC challenge of a clinical lab …

FTC Opposes LabCorp’s Acquisition of Westcliff Read More »

To access this post, you must purchase The Dark Report.