CEO SUMMARY: Annual healthcare spending now pushes past $2.5 trillion and this summer’s debate about how to best reform healthcare in the United States will be raucous and emotional. For the laboratory testing industry, the stakes are immense. THE DARK REPORT identifies two primary threats to the lab testing profession. One is spending cuts to …

Healthcare Reform and Threats to Lab Testing Read More »

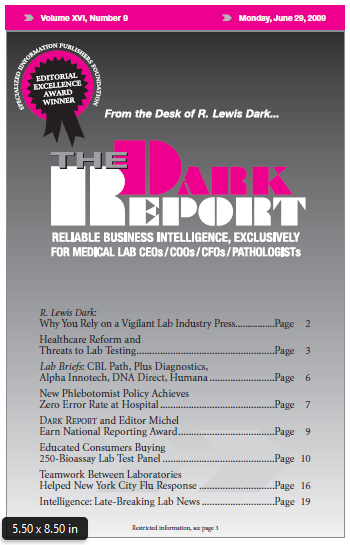

To access this post, you must purchase The Dark Report.