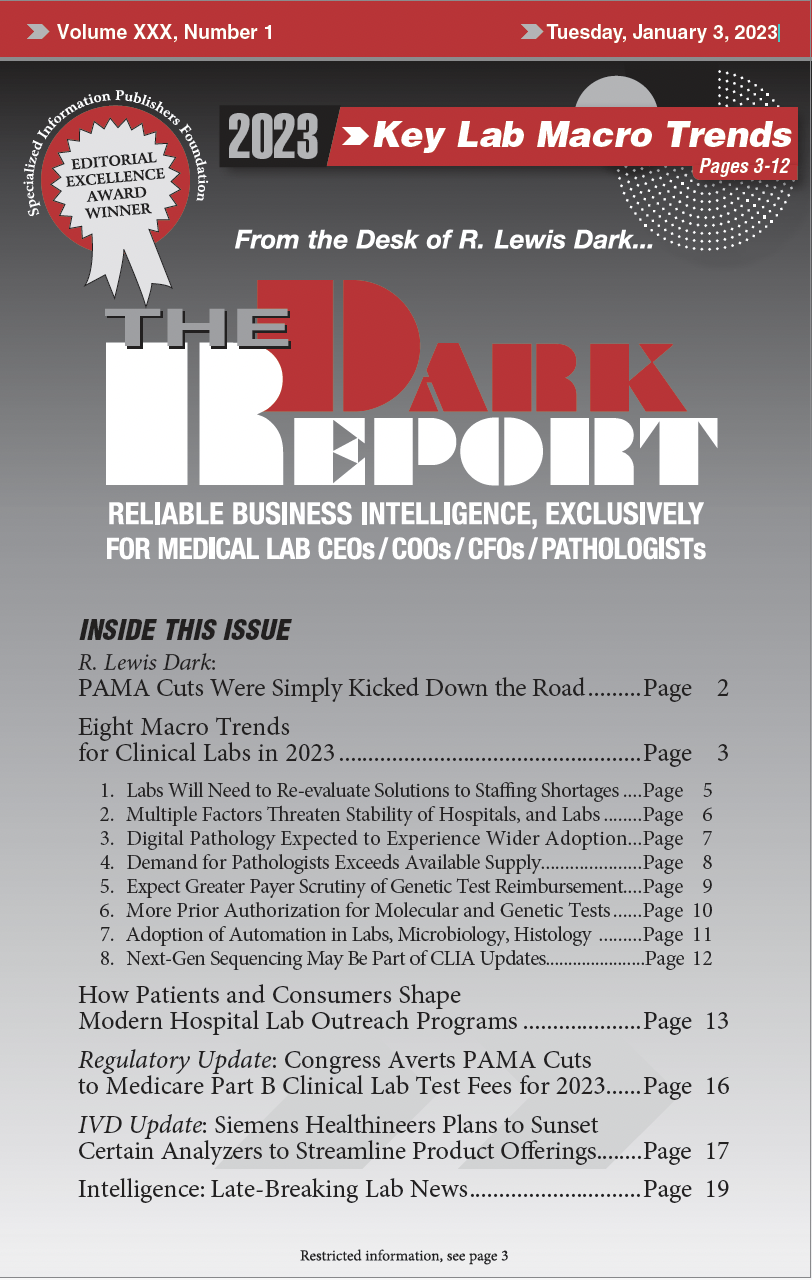

CEO SUMMARY: Laboratory administrators and pathologists will want to carefully study eight important trends that will guide their business strategies in 2023. Many of these macro trends center on financial and operational difficulties and ways to steer around these obstacles. Another broad theme is how established technology is poised in the new year to tackle …

Eight Macro Trends for Clinical Labs in 2023 Read More »

To access this post, you must purchase The Dark Report.