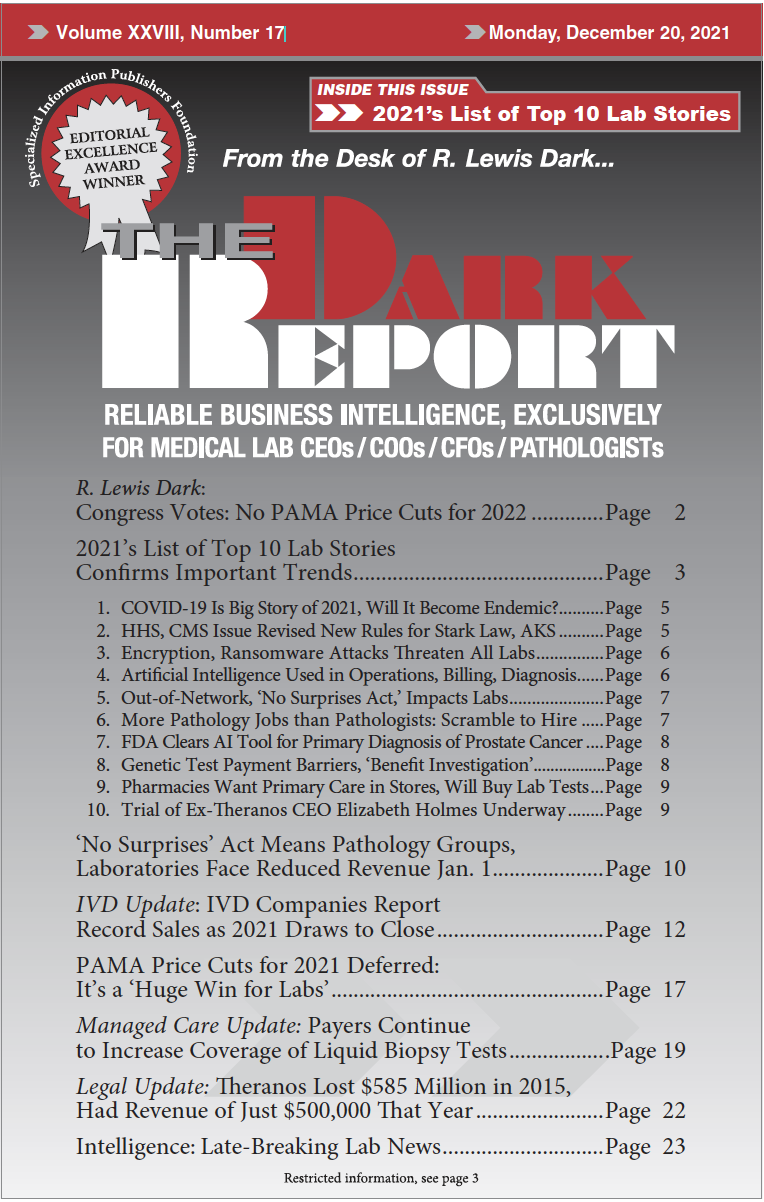

CEO SUMMARY: Much like 2020, the pandemic dominated our new list of the top 10 lab industry stories for 2021. Beyond COVID-19 testing, the virus crept its way into long-term trends, such as pathology jobs and technology innovation. New ways of delivering healthcare will need responses by clinical laboratories, as will significant developments in the […]

To access this post, you must purchase The Dark Report.