SINCE THE FIRST BLOOD-BASED, circulating-tumor DNA (ctDNA) sequencing test for cancer became available in 2014, federal and private payer coverage of these so-called “liquid biopsy” tests has increased substantially. Now, clinical laboratory and pathology directors can expect additional coverage as the clinical utility of these assays becomes more widely accepted. The lead author of a …

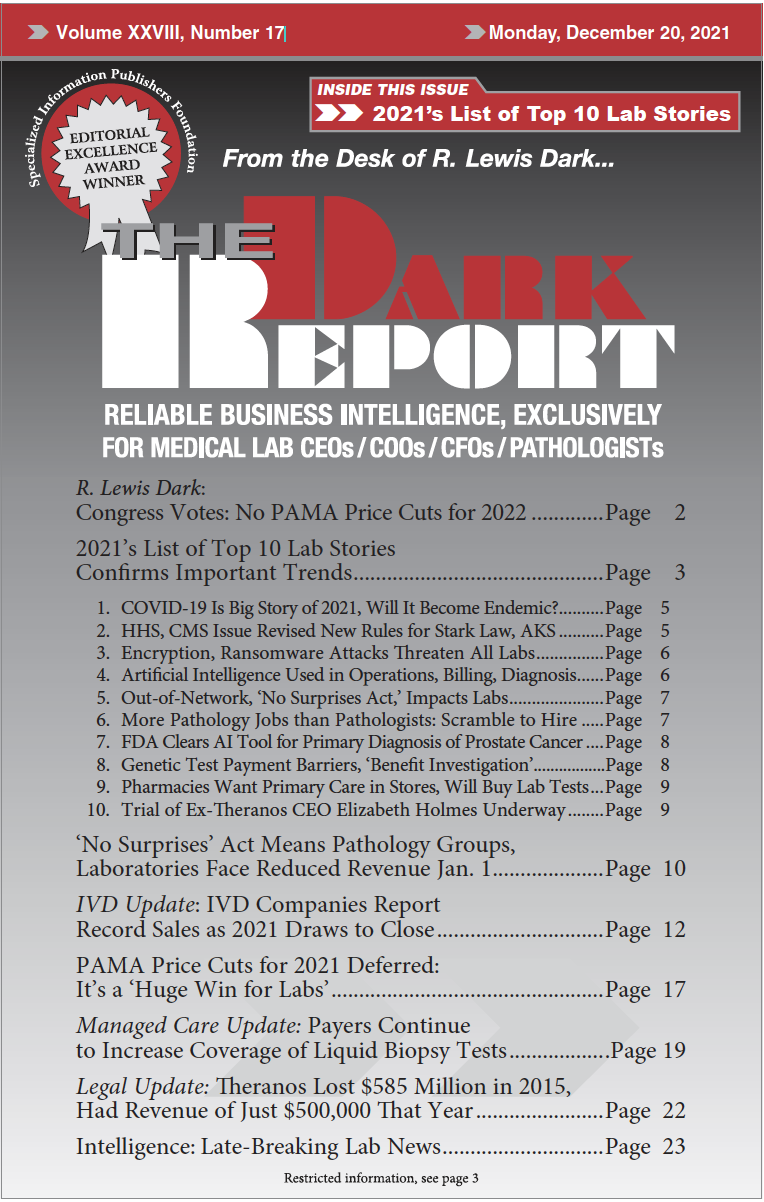

Payers Continue to Increase Coverage of Liquid Biopsies Read More »

To access this post, you must purchase The Dark Report.