JUDGING BY THE THIRD QUARTER FINANCIAL PERFORMANCE of the major in vitro diagnostics (IVD) manufacturers, the demand for COVID-19 testing continues to generate a substantial stream of revenue. During their respective conference calls with investors and financial analysts, IVD company leaders associated revenue growth with increased sales of tests and supplies while noting the gradual …

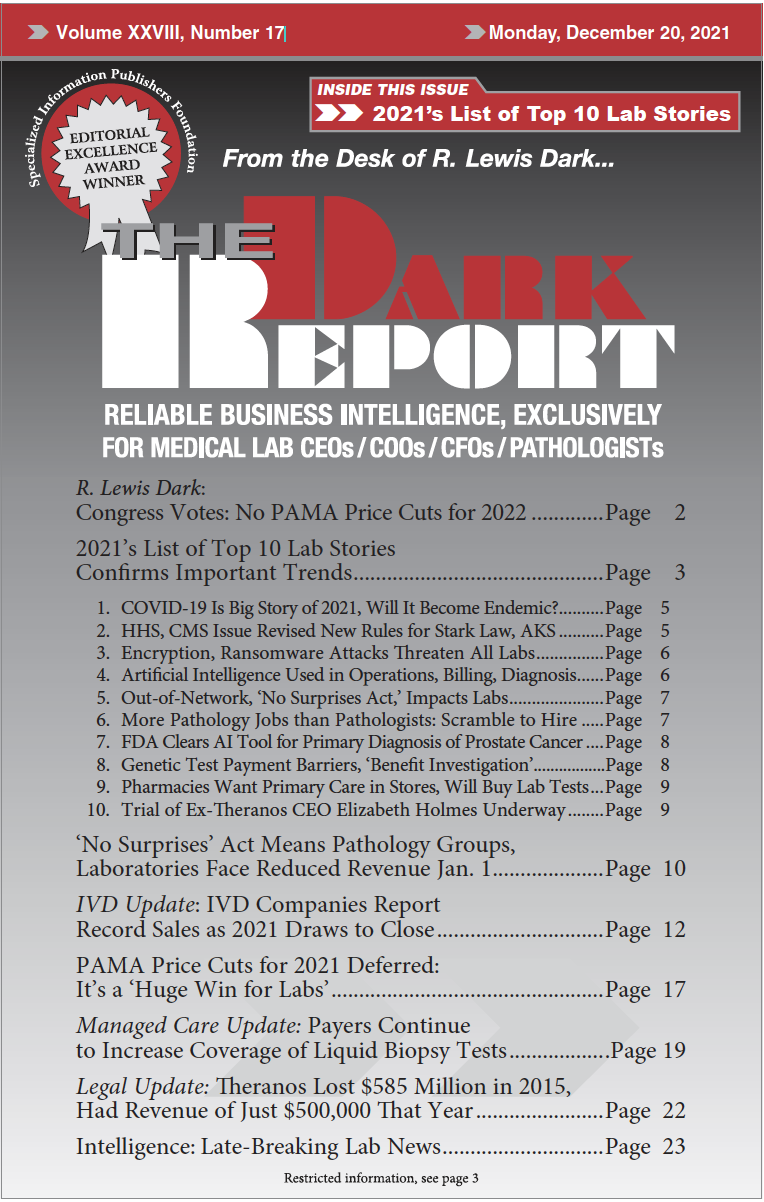

IVD Companies Report Record Sales as 2021 Draws to Close Read More »

To access this post, you must purchase The Dark Report.