CEO SUMMARY: Attempts to organize pathology practice management companies encounter resistance and market impediments. Success requires an astute business plan and a sophisticated management team to convince pathologists to abandon proven practice models and affiliate with regional or national pathology companies. PATHOLOGISTS ARE NOTORIOUS for their skepticism and resistance to change. However, during the last …

Success Seems Elusive To Pathology Innovators Read More »

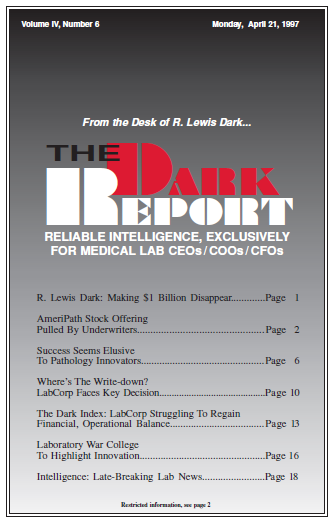

To access this post, you must purchase The Dark Report.