CEO SUMMARY: 1997 will be a “make or break” year for Laboratory Corporation of America. The company is challenged on many fronts. As LabCorp’s management focuses on internal issues, nimble laboratory competitors have an opportunity to capture additional market share. STABILITY CONTINUES to elude Laboratory Corporation of America. Wracked by a variety of setbacks over …

LabCorp Struggling To Regain Financial, Operational Balance Read More »

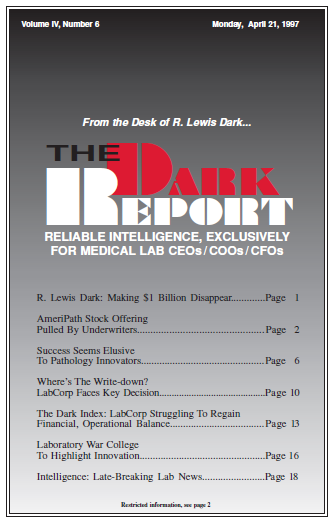

To access this post, you must purchase The Dark Report.