CEO SUMMARY: Even as pressures to squeeze costs and consolidate within the pathology profession ease, a different set of market trends is exerting influence. Collectively, these trends portend the end of the small pathology group’s dominance of its local healthcare marketplace. It will become increasingly important for successful pathology groups to offer a full range …

Path Trends For 2002 Show Future Direction Read More »

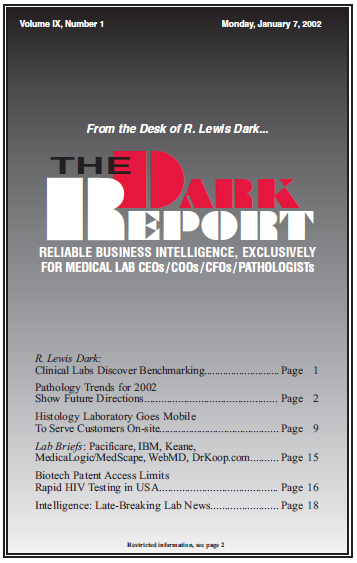

To access this post, you must purchase The Dark Report.