CEO SUMMARY: Miraca Life Sciences amended its merger agreement with Avista Capital Partners after the lab lost value in the two months since the agreement was signed in September. Factors precipitating the revision were a significant decline in reimbursement rates, stiff competition from physician-office labs (POLs), and a loss of specimen volume to POLs and …

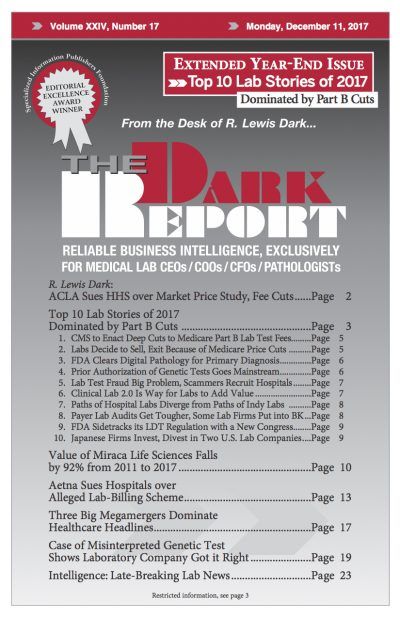

Value of Miraca Falls By 92% from 2011 to 2017 Read More »

To access this post, you must purchase The Dark Report.