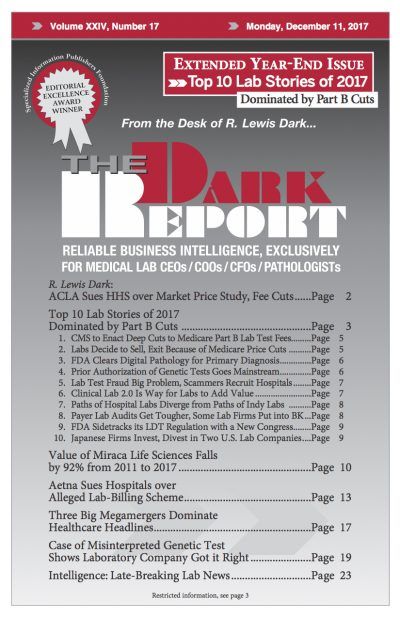

CEO SUMMARY: In September, Aetna filed a lawsuit in Pennsylvania accusing 14 defendants—including a hospital, a hospital management company, eight lab companies or lab management companies, two physicians, and two individuals—of defrauding Aetna, its client employers, and its members. The lawsuit is an example of a lab test arrangement in which independent lab companies and …

Aetna Sues Hospitals over Alleged Lab-Billing Scheme Read More »

To access this post, you must purchase The Dark Report.