CEO SUMMARY: Is the New Year’s spate of deals involving the sales of hospital lab outreach programs and a new joint venture the first tremors of an impending earthquake of similar transactions? In the first 10 weeks of 2017, Laboratory Corporation of America, Quest Diagnostics, and Sonic Healthcare announced significant agreements to purchase sizeable hospital …

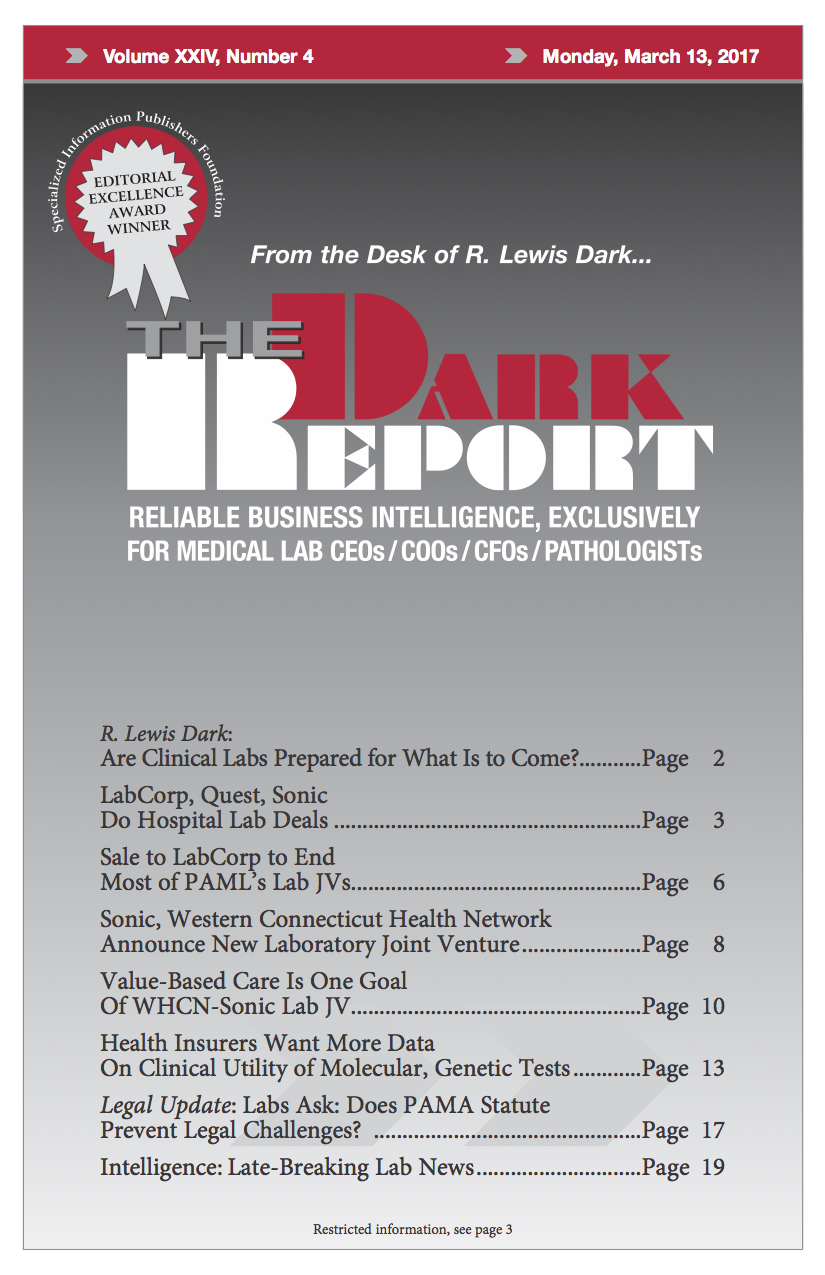

LabCorp, Quest, Sonic Do Hospital Lab Deals Read More »

To access this post, you must purchase The Dark Report.