CEO SUMMARY: Experts in lab compliance predict that clinical laboratories and anatomic pathology groups must anticipate tougher enforcement of federal and state laws this year. One source of increased compliance risk for lab companies is the rising use of third-party marketing agreements. David Gee, an experienced lab industry attorney at Davis Wright Tremaine, said lab …

Use of ‘1099 Marketers’ and Lab Compliance Risk Read More »

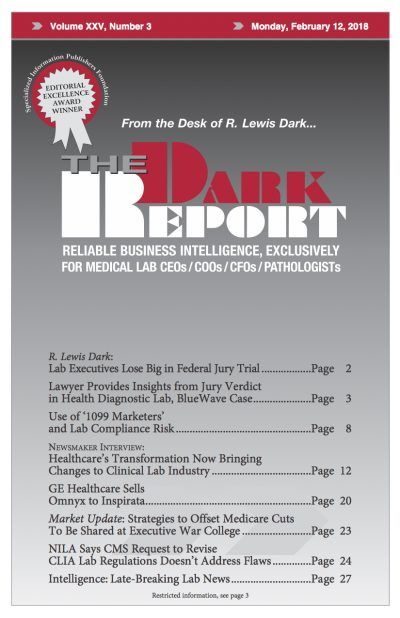

To access this post, you must purchase The Dark Report.