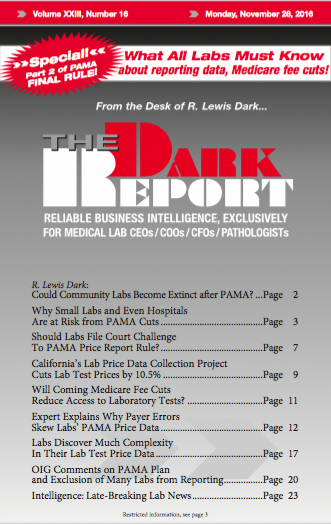

CEO SUMMARY: Clinical lab executives and experts who have studied the final rule for PAMA lab test market price reporting are seriously concerned that the design of this rule may put many of the nation’s smallest, but still essential, clinical labs at great risk of financial distress, if not outright failure. In this exclusive analysis, […]

To access this post, you must purchase The Dark Report.