CEO SUMMARY: In its work with more than 200 lab clients, XIFIN, Inc., of San Diego, sees the best and worst of problems in how labs submit claims to lab tests and how payers process these claims. In this exclusive interview, Lâle White, XIFIN’s Founder and CEO, identifies the systemic sources of problems in the …

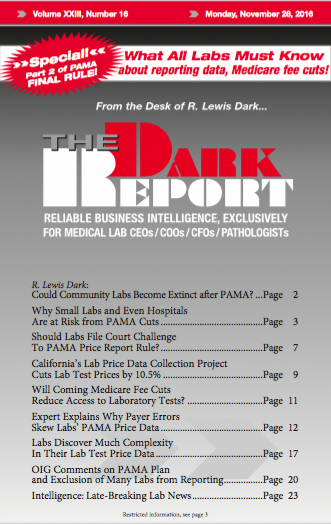

Expert Explains Why Payer Errors Skew Labs’ PAMA Price Data Read More »

To access this post, you must purchase The Dark Report.