ON THE SUBJECT OF LAB TEST MARKET PRICE REPORTING as required under PAMA, many clinical laboratory executives, pathologists, and industry experts see deep flaws in the process the federal Centers for Medicare & Medicaid Services has established. Yet, CMS itself seems blind to these flaws. Fortunately, the clinical lab executives are not alone. The Office …

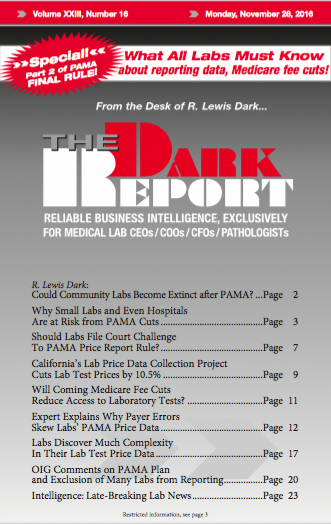

OIG Comments on PAMA Plan and Exclusion of Many Labs from Reporting Read More »

To access this post, you must purchase The Dark Report.