SPECIALTY LABORATORIES RESTORING STABILITY IN SPECIMEN VOLUME IT’S NO SURPRISE THAT COMPETITORS of Specialty Laboratories, Inc. have been willing to spread a variety of rumors about the laboratory company, given its well-publicized troubles with government regulators last year. Notwithstanding these rumors, the reality at Specialty Labs is quite different. On April 24, the company, based …

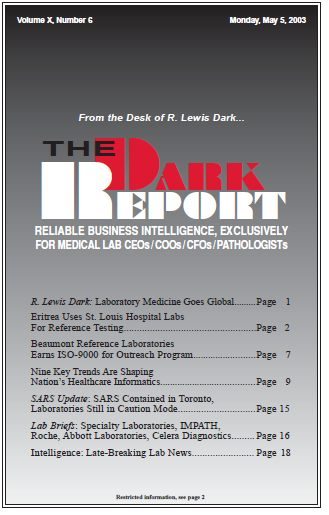

Specialty Laboratories, IMPATH, Roche, Abbott Laboratories, Celera Diagnostics Read More »

To access this post, you must purchase The Dark Report.