IN RECENT WEEKS, the nation’s two largest lab companies reported fourth quarter and full-year earnings for 2015. The earnings reports reveal how the paths of the two companies are diverging. The companies are diverging because of a major acquisition made in February 2015, by Laboratory Corporation of America. LabCorp bought Covance Inc. in a deal valued …

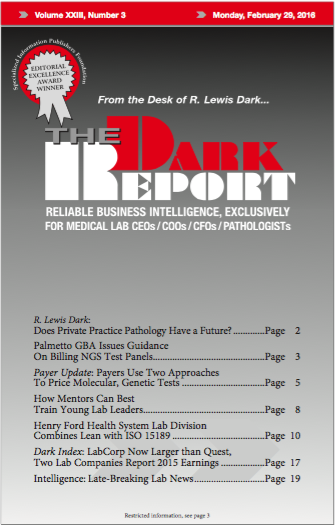

LabCorp Now Larger than Quest, Two Labs Report 2015 Earnings Read More »

To access this post, you must purchase The Dark Report.