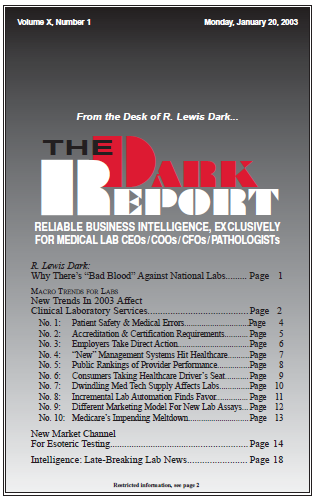

CEO SUMMARY: Here’s our current list of macro trends that affect clinical laboratories, updated from the last list in January 2000. One bold prediction is that Medicare, as we know it, is on the verge of a major meltdown. Employers and consumers are also new forces to be reckoned with by healthcare providers. Factors other …

New Trends in 2003 Affect Clinical Lab Services Read More »

To access this post, you must purchase The Dark Report.