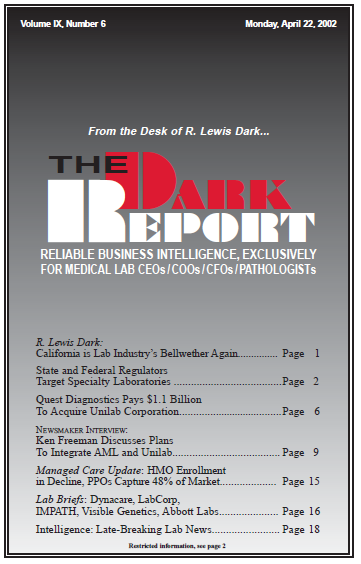

CEO SUMMARY: Once again, Ken Freeman and Quest Diagnostics Incorporated is altering the national market for clinical laboratory testing. By acquiring American Medical Laboratories and Unilab, the nation’s largest lab company is expanding its presence in California, Nevada, and Washington, DC. In this exclusive interview with THE DARK REPORT, Chairman and CEO Ken Freeman explains …

Ken Freeman Discusses Plans to Integrate AML and Unilab Read More »

To access this post, you must purchase The Dark Report.