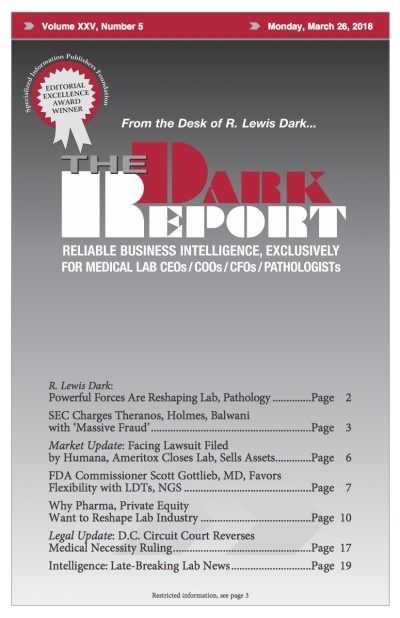

This is an excerpt from a 2,920-word article in the March 26, 2018, issue of THE DARK REPORT. The complete article is available for a limited time to all readers, and available at all times to paid members of the Dark Intelligence Group. CEO SUMMARY: Here’s the first look for the lab industry at an …

To access this post, you must purchase The Dark Report.