CEO SUMMARY: In an action against Theranos and two of its executives, the SEC said in a federal court filing this month that the company, CEO Elizabeth Holmes, and former COO Ramesh “Sunny” Balwani deceived investors into believing that the company’s portable blood analyzer could conduct comprehensive blood tests from drops of blood collected via …

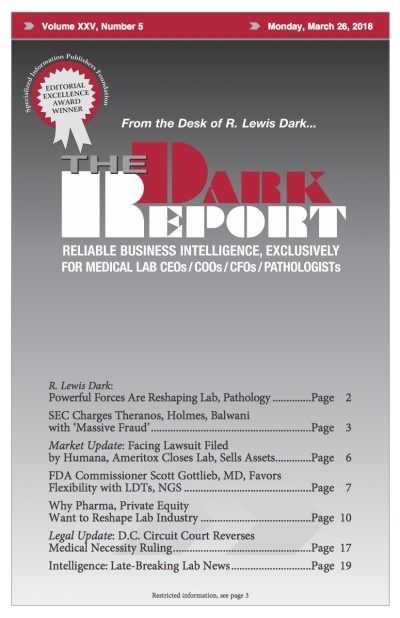

SEC Charges Theranos with ‘Massive Fraud’ Read More »

To access this post, you must purchase The Dark Report.