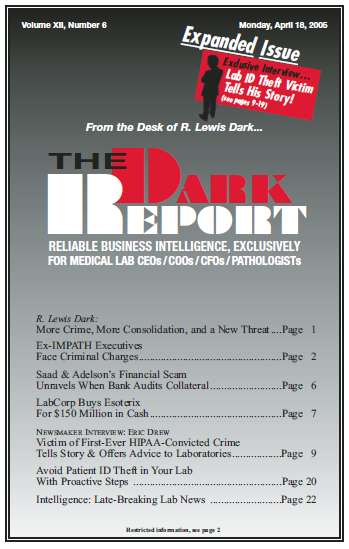

“I figured the hospital would be subject to a multi-million dollar HIPAA lawsuit if my hospital records were proven breached—which is exactly what happened.” —Eric Drew, cancer patient and patient identity theft victim CEO SUMMARY: Eric Drew’s story may be one of the most amazing to have happened in the modern age of laboratory medicine. …

Victim of First HIPAA-Convicted Crime Tells Story & Offers Advice to Labs Read More »

To access this post, you must purchase The Dark Report.