CEO SUMMARY: Laboratory Corporation of America continues to display an appetite to grow by acquisition. However, its purchase of Esoterix, Inc. creates unique management problems for LabCorp, because Esoterix is itself a product of a lab acquisition strategy. Over the past ten years, Esoterix acquired national specialty labs in coagulation, endocrinology, flow cytometry, and allergy …

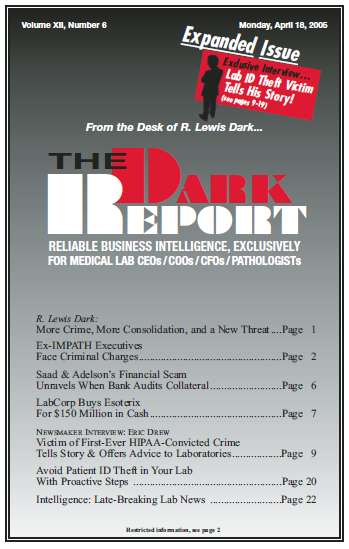

LabCorp Buys Esoterix For $150 Million in Cash Read More »

To access this post, you must purchase The Dark Report.