CEO SUMMARY: After several months of delays, Physician Solutions recruited a new CEO and completed arrangements to receive $20 million in venture capital funding. These two milestones mean that the pathology-based physician practice management company will soon be ready to launch formal business operations. EVENTS ARE UNFOLDING RAPIDLY at Physician Solutions. During the month of …

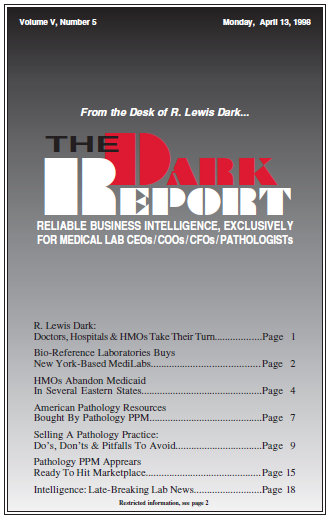

Pathology PPM Appears Ready To Hit Marketplace Read More »

To access this post, you must purchase The Dark Report.