CEO SUMMARY: Here is an independent commercial laboratory that shows sustained growth while it maintains profitable operations. One key strategy is the selective acquisition of laboratory business in small, profitable chunks. The sales price paid for Medilabs demonstrates how much decline has occurred to the value of clinical laboratories. DESPITE THE PROFIT SQUEEZE on commercial …

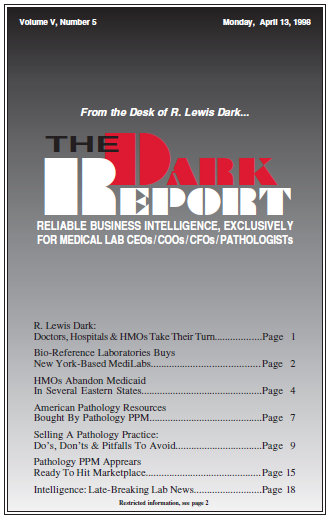

Bio-Reference Labs Buys New York-Based Medilabs Read More »

To access this post, you must purchase The Dark Report.